san francisco gross receipts tax instructions 2020

To begin filing your 2020 Annual Business Tax Returns please enter. This tax is imposed on companies that earn more than 50M per.

Key Dates Deadlines Sf Business Portal

File Annual Business Tax Returns 2020.

. Lean more on how to submit these installments online to comply with the Citys business and tax regulation. New Levy on Overpaid Executives to Take Effect in 2022. Engaged in business in San Francisco as defined in Code section 62-12 Qualified by Code sections 9523 f and g Were not otherwise exempt under Code sections 906 or 954.

This tax ranges from 0175 0690 of taxable gross receipts depending on the industry and is 15 for administrative offices. Line 15 Excludable Taxes. A pays the tax liabilityfor the group and then is reimbursed by Bfor Bs portion of the tax paid.

To avoid late penaltiesfees the returns must be submitted and paid on or before April 30 2021. How do the tax authorities determine gross. Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing relief to certain industries and small businesses.

2020 San Francisco Gross Receipts Tax Oregon Tax Proposal is Gross Idea for Consumers Prosperity somewhat Reasonable softwood and a look at how tree growers are surviving in todays market afoa news issues information Somehow we manage to others are larger like the new gross receipts tax proposed by the oregon senate yesterday under the proposal oregon. San Francisco Set to Begin 2021 With Gross Receipts Tax Increase. City and County of San Francisco 2000-2020.

1 Page Ceasing Business Instructions. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. Your seven 7 digit Business Account Number.

Persons other than lessors of residential real estate must file a Return if they were engaged in business in San Francisco in as defined in 2020 Code section 62-12 qualified by Code sections. Gross Receipts Tax GR Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. 2022 S-78 current2016 Building Inspection Codes Planning Zoning Map Archive April 1 2022 Planning Zoning Map Archive March 1 2022 Planning Zoning Map Archive February 1 2022 Planning Zoning Map Archive January 1 2022 Planning Zoning Map Archive December 1 2021 Planning Zoning Map Archive November 1 2021 Planning Zoning Map Archive.

Non-Exempt Persons Other Than Lessors of Residential Real Estate. 1 reduce the annual Business Registration Fee for businesses with 1000000 or less in San Francisco gross receipts 2 increase the small business exemption ceiling for the Gross Receipts Tax to 2000000 and increase the annual Business Registration Fee on businesses. The new tax takes effect on January 1 2022 and will be imposed on businesses in which the highest-paid executives total compensation is more than 100 times the median San Francisco-based employee compensation.

San Francisco Gross Receipts Tax Update. San Francisco voters on November 3 2020 approved two propositions that will increase the citys gross receipts tax. To avoid late penaltiesfees the returns must be submitted and paid o n or before February 28 2022.

San Francisco approves ballot initiatives on increasing Gross Receipts Tax and taxing companies with certain CEO pay ratios. This document provides instructions for the 2020 Gross Receipts Tax and Payroll Expense Tax Ceasing Business Filing the Return for residential landlords lessors of. Upsell_block Estimated tax due for both self-employment and income taxes.

Filling the forms involves giving instructions to your assignment. On November 3 2020 San Francisco voters approved Proposition F Business Tax Overhaul and Proposition L Overpaid CEO Tax by overwhelming majorities. For the business activity selected enter the.

The progressive tax rate ranges between 01 to 06 and is assessed on gross receipts sourced to San Francisco as determined for Gross Receipts Tax purposes. Both measures were passed by voters with overwhelming majorities. The Business Tax Overhaul proposal which seeks to reform the citys current business tax regime will appear on the ballot.

Had more than 300000 in taxable San Francisco payroll expense. Proposition F or the Business-Tax Overhaul supported by 68 of voters will be effective in. The due date for filing the san francisco 2021 annual business tax sf abt return which includes reporting and payment of 1 the gross receipts tax grt or administrative office tax aot 2 the homelessness tax hgrt or the homelessness administrative office tax haot and 3 the commercial rents tax crt is february 28 2022.

In November of 2020 San Francisco voted to increase Gross Receipt Tax rates in a shift to do away with the payroll tax and slowly increase GRT by 40 in all industries up to 104 for some categories. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. After the pop up box is closed the sum of the Total within and outside San Francisco and the sum of the Total within San Francisco will display in line 14 on Gross Receipts Page.

The changes are reflected in the 2021 Annual Business Tax filings due February. In early 2020 the IRS put special rules in place for filing estimated taxes during the COVID-19 pandemic but nearly all of those rules did not apply beyond July 2020. San Franciscos Overpaid Executive Gross Receipts Tax OEGRT will.

The Business Tax Overhaul which was passed by 68 of voters 2 will increase most of the. Gross Receipts Tax and Payroll Expense Tax. In other news the San Francisco Director of Elections has assigned labels to two propositions that will appear on the November 2020 ballot related to the San Franciscos gross-receipts tax on businesses operating in the city see Tax Alert 2020-2107.

Overpaid Executive Gross Receipts Tax Approved in San Francisco. Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. Beginning in 2021 Proposition F named the Business Tax Overhaul raises gross receipts tax rates for all businesses when it is.

The last four 4 digits of your Tax Identification Number. On June 30 2020 the First District of the California Court of Appeal upheld the legality of the City and County of San Franciscos Homelessness Gross Receipts Tax. City and County of San Francisco Office of the Treasurer Tax Collector 2020 Annual Business Tax Returns.

San franciscos gross receipts tax grt is calculated based on individual employees time spent in sf. Imposing the Commercial Rents Tax or Homelessness Gross Receipts Tax as applicable. San Francisco Voters Approve Increase in Gross Receipts Tax and New Tax on CEO Pay.

Proposition F would amend the San Francisco Charter and City ordinances to. City and County of San Francisco Office of the Treasurer Tax Collector Gross Receipts Tax Payroll Expense Tax Ceasing Business Filing Instructions Tax Year 2020. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax.

Tax and homelessness gross receipts tax that would otherwise be due on april 30 2020 are waived for taxpayers or combined groups that had combined san francisco gross receipts in calendar year 2019 of 10000000 or less. Had more than 1120000 in combined taxable San Francisco gross receipts. You also give your assignment instructions.

File Annual Business Tax Returns 2021 Instructions. 3 hours agoUnder the measure the business tax would range from 45 cents to 1040 per 1000 of. On November 3 2020 San Francisco voters approved two new tax measures impacting corporate taxpayers.

Taxpayers Reminded San Francisco Gross.

San Francisco Giants Revenue 2021 Statista

France Hsbc Bank Statement Template In Word And Pdf Format Bank Statement Statement Template Templates

Homelessness Gross Receipts Tax

Total Gross Domestic Product For San Francisco Oakland Hayward Ca Msa Ngmp41860 Fred St Louis Fed

San Francisco Gross Receipts Tax

Due Dates For San Francisco Gross Receipts Tax

Annual Business Tax Returns 2020 Treasurer Tax Collector

San Francisco Giants Operating Income 2021 Statista

Annual Business Tax Return Treasurer Tax Collector

Court Upholds S F S Proposition C Homelessness Funds San Francisco Business Times

Annual Business Tax Return Treasurer Tax Collector

Homelessness Gross Receipts Tax

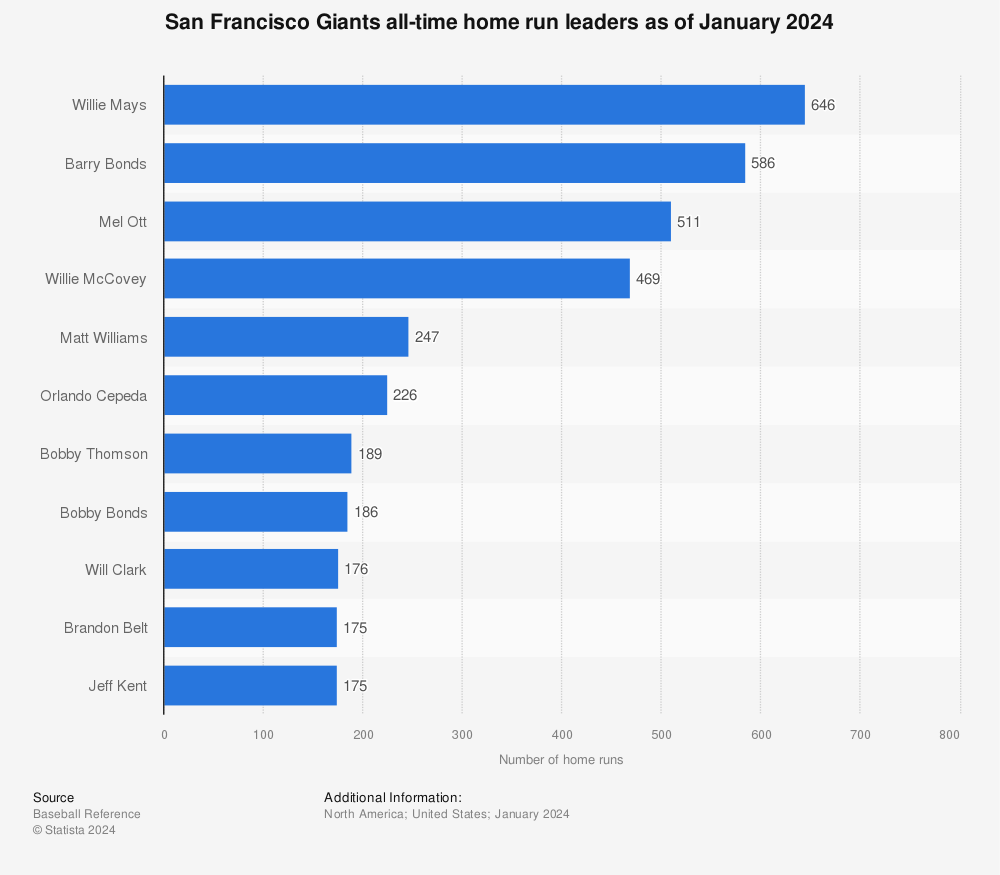

San Francisco Giants All Time Home Run Leaders 2021 Statista

California San Francisco Business Tax Overhaul Measure Kpmg United States

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Sweden Citibank Statement Easy To Fill Template In Doc Format Fully Editable Statement Template Templates Sweden

Overpaid Executive Gross Receipts Tax Approved Jones Day

California High Court Lets San Francisco S Disputed Homeless Tax Stand Courthouse News Service